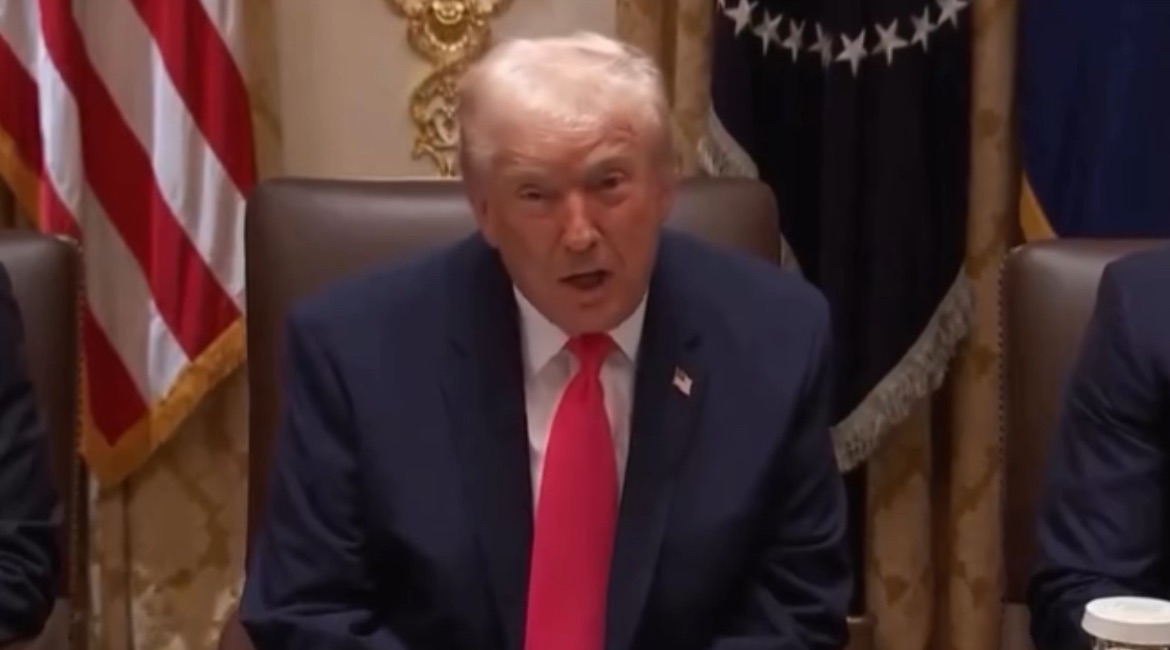

President Donald Trump has recently suggested that “in the not-too-distant future,” Americans may no longer have to pay federal income tax. The idea, which has been circulating across news clips and political talk shows, centers on replacing income tax with revenue generated from tariffs — the taxes placed on imported goods.

According to Trump, the U.S. could rely heavily on tariff-driven income to fund the federal government, potentially reshaping the tax system more dramatically than any time in the last century. He has also floated the idea of “tariff dividend” checks to Americans, funded directly from tariff revenue rather than income taxes.

Potential Benefits Supporters Highlight

- No more federal income tax. Supporters say Americans would keep more of their paycheck if income taxes were eliminated (CPA Practice Advisor).

- Government funded through tariffs instead of wages. The financial burden shifts from workers’ incomes to imported goods (Fox Business).

- Possibility of “tariff dividend” checks. Trump suggested Americans could receive rebate checks funded by tariff revenue (CBS News).

- A simpler tax system overall. Eliminating income tax could dramatically reduce paperwork and complexity (Tax Policy Center).

Key Concerns Critics Warn About

- Tariffs likely can’t replace income tax revenue. Experts say tariffs generate far less revenue than the $2–3 trillion income taxes bring in yearly (Newsweek).

- Consumers could face higher prices. Tariffs often raise the price of imported goods, which critics say becomes a hidden tax on families (Tax Foundation).

- Risk of higher deficits or debt. If tariff revenue falls short, the government may struggle to cover essential services (Tax Policy Center).

- Legal and political barriers. Eliminating federal income tax would require major legislative changes that face uncertain approval (Tax Policy Center).

- Potential economic instability. Large-scale tariffs could increase inflation and slow economic growth (Intereconomics).

This proposal is one of the boldest tax ideas floated in modern politics — and whether it becomes policy or stays a campaign talking point, it’s already sparked a nationwide debate.